- About BDF

- Programs

- To banks

- For enterprises

- News BDF

- Public information

News BDF22 October, 2025Business Development Fund Strengthens Cooperation with European Donors and Prioritizes Microbusiness Growth

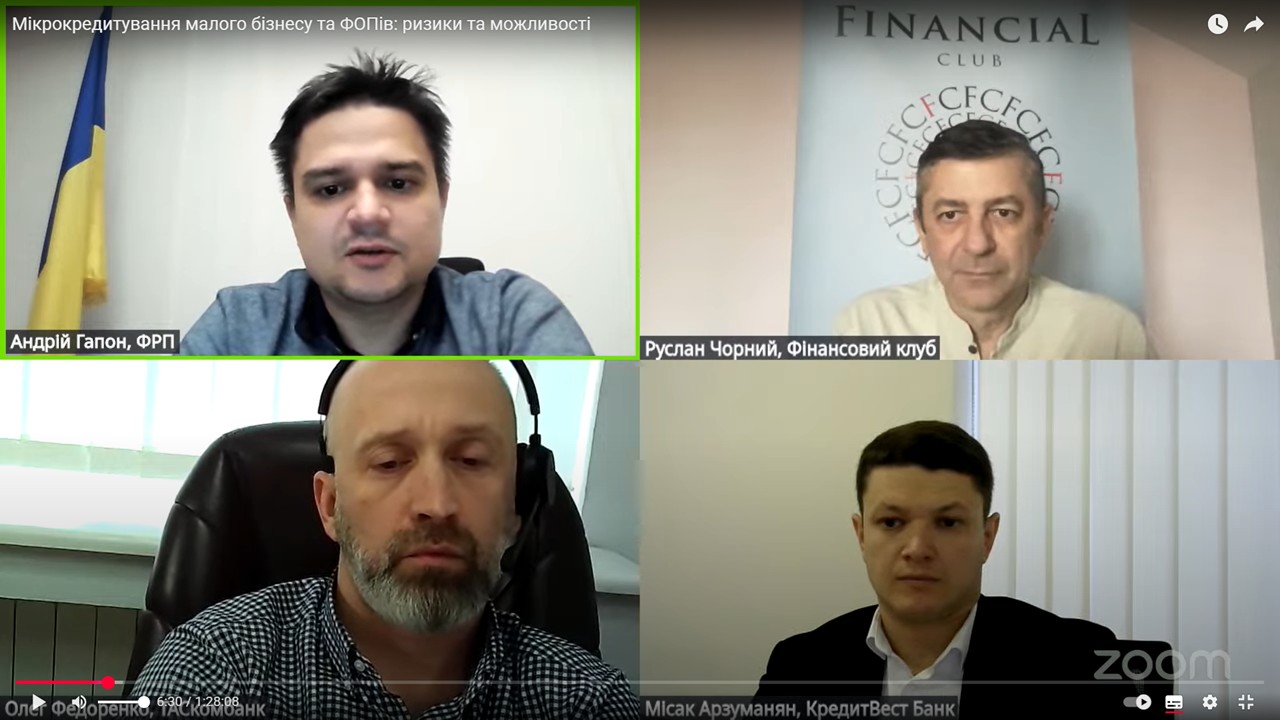

Chairperson of the Board of the Business Development Fund, Andrii Hapon, participated in a roundtable discussion titled “Microlending for Small Businesses and Private Entrepreneurs: Risks and Opportunities”, organized by the Financial Club.

In his remarks, Mr. Hapon noted that the Business Development Fund is approaching its 30th anniversary, and that microlending was the very first program that marked the Fund’s inception.

Speaking about the Fund’s institutional transformation, he emphasized that its core mission remains unchanged:

“As the National Development Institution, we will deepen our cooperation with European donors — the very partners who initiated the Fund’s reform. Over the years, the Business Development Fund has built a strong reputation among them, thanks to its consistent collaboration with partner banks. We don’t compete with banks, rather, we complement them by offering incentives to continue business lending,” said Andrii Hapon.

One of the Fund’s new strategic directions is a joint project with the Council of Europe Development Bank, aimed at expanding microfinance. Through this initiative, banks will receive not only additional resources for lending to microbusinesses, but also technical assistance to improve their internal systems and client engagement policies.

The Fund also places special emphasis on engaging credit unions, which play a vital role in financing businesses that lack access to traditional bank lending. In many cases, credit unions serve as a growth platform for small enterprises, helping entrepreneurs prepare for future cooperation with banks.

Mr. Hapon also highlighted the Fund’s role as a pioneer in business support innovation. It was the first to introduce state guarantees, leasing support programs, and escrow accounts for public financing initiatives — tools that have already proven their effectiveness.

The State programme “Affordable Loans 5-7-9%” will also be updated, with a reallocation of beneficiaries to prioritize regions facing high war-related risks. Despite these changes, the program will continue to operate and remain a reliable partner for entrepreneurs and banks for at least the next three years.

Participants agreed that microlending remains one of the most effective tools for supporting small businesses and contributing to Ukraine’s overall economic development.